Securing Generational Bitcoin Wealth

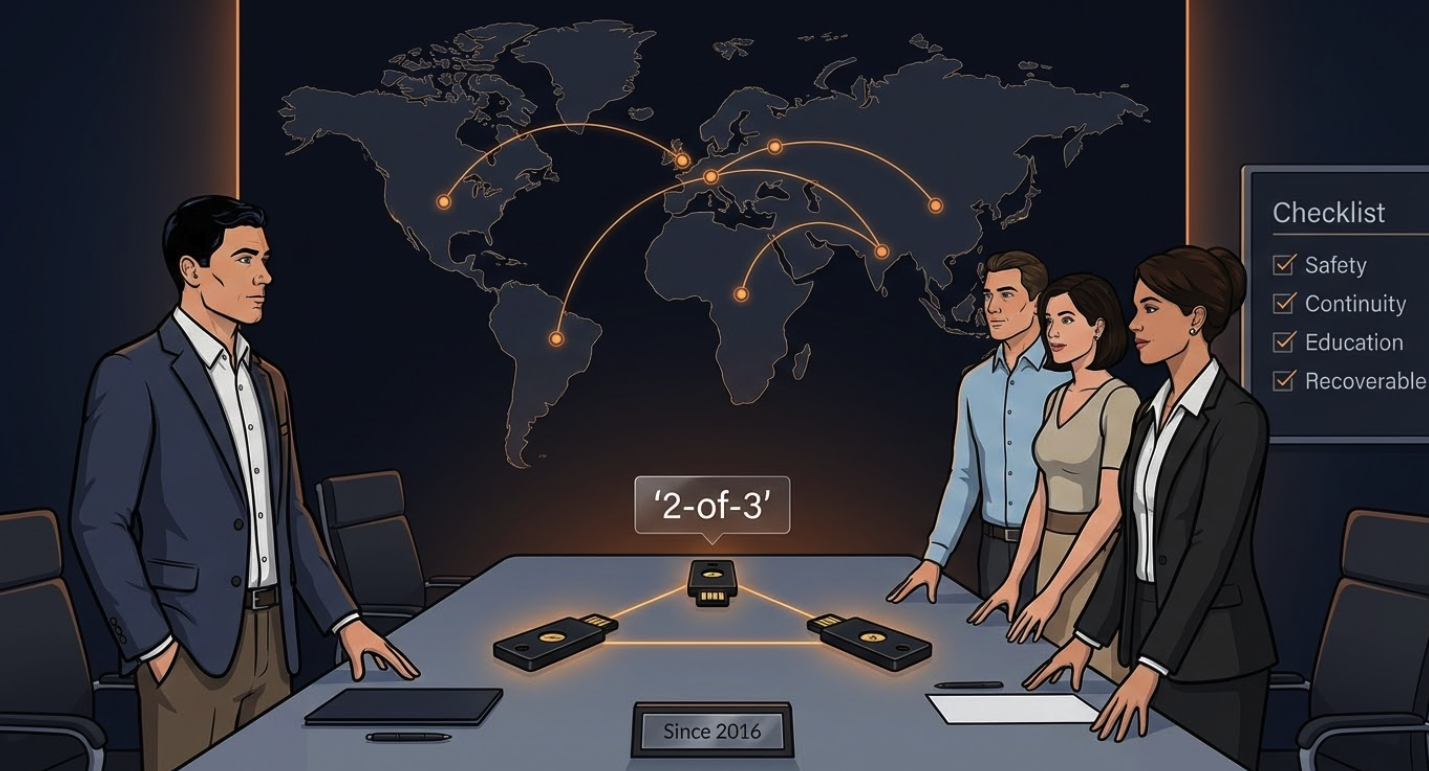

The Bitcoin Adviser helps individuals, families, founders, and institutions worldwide—including the US, UK, and Australia—operate collaborative security vaults so their Bitcoin stays safe, recoverable, and ready to pass on. Since 2016 we’ve turned institutional best practices into a repeatable playbook for every Bitcoiner.

In Short

- Trusted by multi-family offices managing more than $1B in assets, with 10%+ allocated to Bitcoin.

- Expanded in 2023 so every committed Bitcoiner can access institutional-grade custody.

- We focus on safety, continuity, and education—you decide when and how much to buy.

150×–200×

Returns achieved by disciplined clients following collaborative security playbooks.

Zero Losses

No satoshis lost across our vaults—thorough documentation, optional orientations, and audits keep the system resilient.

Global Coverage

Advisers across North America (including the US), Europe, Asia, Australia, New Zealand, Japan, and Africa.

From Multi-Family Offices To Every Bitcoiner

Institutional Roots

We started in 2016 supporting multi-family offices managing more than $1B, with over 10% held in Bitcoin. That experience honed our expertise in collaborative security, estate planning, and beneficiary education.

Opening Access

In early 2023 we opened the same institutional-grade model to every Bitcoiner. Our mission is to protect what you already hold, not to guess the market.

Today we serve founders, family offices, trustees, and self-custody advocates worldwide—removing single points of failure, documenting estate paths, and educating the next generation so your vision endures.

What We Deliver

Collaborative Security

Two-of-three multisig vaults keep you in control while preventing any single party from moving funds. Keys are dispersed, tamper-evident, and monitored.

Estate Planning

Protocols and documentation ensure heirs, trustees, and executors know exactly how to recover Bitcoin without guesswork.

Education & Governance

We train families and partners, refresh devices, audit vaults, and keep everyone aligned through scheduled governance cycles.

Keep learning between sessions through TBA TV's 20+ podcast appearances and the The Bitcoin Adviser GPT on ChatGPT for on-demand answers.

What We Do & What We Don't

The Bitcoin Adviser provides defined, technical services focused on Bitcoin custody, security, and estate planning. We are not a holistic financial adviser, investment adviser, lending adviser, or balance-sheet adviser. Understanding these boundaries helps set proper expectations.

What We Provide

The Bitcoin Adviser delivers technical services for Bitcoin security and inheritance:

- Collaborative security vault design and implementation

- Estate plan protocols and documentation

- Beneficiary education and recovery planning

- Ongoing vault governance and support

- Technical guidance on Bitcoin custody best practices

Clients remain responsible for: investment decisions, leverage choices, external assets, consolidated reporting, and coordinating with their own investment advisers, tax professionals, and legal counsel.

What We Don't Do

To maintain clear boundaries, The Bitcoin Adviser does not:

- Manage client funds or make investment decisions

- Monitor leverage or margin positions

- Prepare consolidated net worth statements

- Act as executor, trustee, or investment manager

- Provide ongoing visibility into third-party loan arrangements unless explicitly engaged to do so

- Serve as a client's "Bitcoin adviser of record" for balance-sheet purposes

We are a specialist operator providing technical services, not a delegator of personal accountability. Clients retain full decision-making responsibility for all investment and leverage decisions.

20+ Podcast Appearances on Leading Bitcoin Shows

Peter regularly appears on top Bitcoin podcasts including What Bitcoin Did, The Honest Money Show, and Crypto Collective, sharing insights on collaborative security, estate planning, and generational wealth transfer. Explore the full catalog of appearances, interviews, and educational content.

Why We're All-In On This Asset

Volatility Is Discovery

Price swings reflect an emerging monetary network, not structural fragility. Fixed supply, growing adoption, and disciplined planning reward patient stewards.

Resilient By Design

Bitcoin’s open-source, decentralised architecture makes blanket bans impractical. We help families understand sound money principles so confidence replaces fear.

Scarcity, durability, portability, and neutrality are the cornerstones of Bitcoin. We translate the cryptography and economics into practical tools any motivated family can use.

Collaborative Security In Practice

How Multisig Works

You hold one key, The Bitcoin Adviser holds another, and a vetted third-party partner holds the third. Any spend requires two approvals, so no single party—including us—can move funds alone.

- Keys stored in separate jurisdictions with tamper-evident controls.

- Incident playbooks for compromised hardware or unresponsive signers.

- On-chain transparency so you can audit vault activity whenever you wish.

Continuous Governance

Security is a process. We schedule recovery drills, update contact trees, refresh hardware, and document every change so the vault is always battle-ready.

Passing Bitcoin Without Losing A Sat

Map Responsibilities

Identify signers, executors, trustees, beneficiaries, and professional partners so everyone understands their role ahead of time.

Document & Secure

We prepare instructions, legal inserts, and tamper-evident packets that work alongside your trust and estate documents.

Guide Recoveries

Annual drills confirm your team can locate keys, authenticate requests, and execute withdrawals—even if you are unavailable.

Educate Heirs

We guide beneficiaries through the glossary, vault operations, and collaboration with advisers so they inherit confidence, not confusion.

If you cannot explain how your heirs recover Bitcoin today, it is time to build the plan. Legacy preservation depends on people, process, and documentation working in sync.

Transparent Pricing, Tangible Outcomes

Value Beyond 1%

Our 1% annual fee—paid in sats—covers ongoing security governance, estate support, beneficiary training, and emergency response. Clients consistently cite the peace of mind as invaluable. See full pricing details →

What You Receive

- Collaborative security multisig vaults with independent oversight.

- Continuous guidance, from onboarding through quarterly reviews.

- Education for families exploring new allocation opportunities.

Global Advisers, Local Expertise

Partners Peter Dunworth and Andy Pattinson lead a worldwide team spanning Australia, New Zealand, Japan, the Americas, Europe, and Africa. Many advisers founded major Bitcoin initiatives—from hardware wallet suppliers to education platforms and conferences. Andy also created BitcoinSuper.io (Australia's guide to Bitcoin in SMSFs), while the team powers Loan My Coins for BTC-to-BTC liquidity.

Explore biographies, regions, and contact links on the Advisers page.

Our Family of Bitcoin Solutions

Built by the same team—Peter Dunworth, Andy Pattinson, and global Bitcoin Advisers—we extend institutional-grade thinking across the Bitcoin journey:

The Bitcoin Adviser

Secure your stack with collaborative multisig vaults, estate protocols, and ongoing governance. (You are here.)

Loan My Coins

For Terminal Bitcoiners who've maxed accumulation: Stake BTC to borrow BTC at 95% LTV—no margin calls, no liquidations, pure capital efficiency. Explore Loan My Coins →

Bitcoin Super

Australia's canonical guide to holding Bitcoin in Self-Managed Super Funds (SMSFs): Structure, compliance, self-custody with multisig. Created by Andy Pattinson. Visit BitcoinSuper.io →

These services share the same philosophy: sovereignty, documentation, education, and zero single points of failure. Start with custody and legacy (TBA), then layer on retirement wrappers (Bitcoin Super) or liquidity (Loan My Coins) as your needs evolve.

Ready To Secure Your Bitcoin Legacy?

Connect with an adviser to see how collaborative security, estate planning, and beneficiary education can protect your family for decades. Or drop us a line at contact@thebitcoinadviser.com.