1% Annual Fee — Built for Long-Term Bitcoin Holders

Value is remembered long after price is forgotten. We charge a simple 1% annual fee so you can keep 99% of the upside while we focus on securing your Bitcoin for the people you care about.

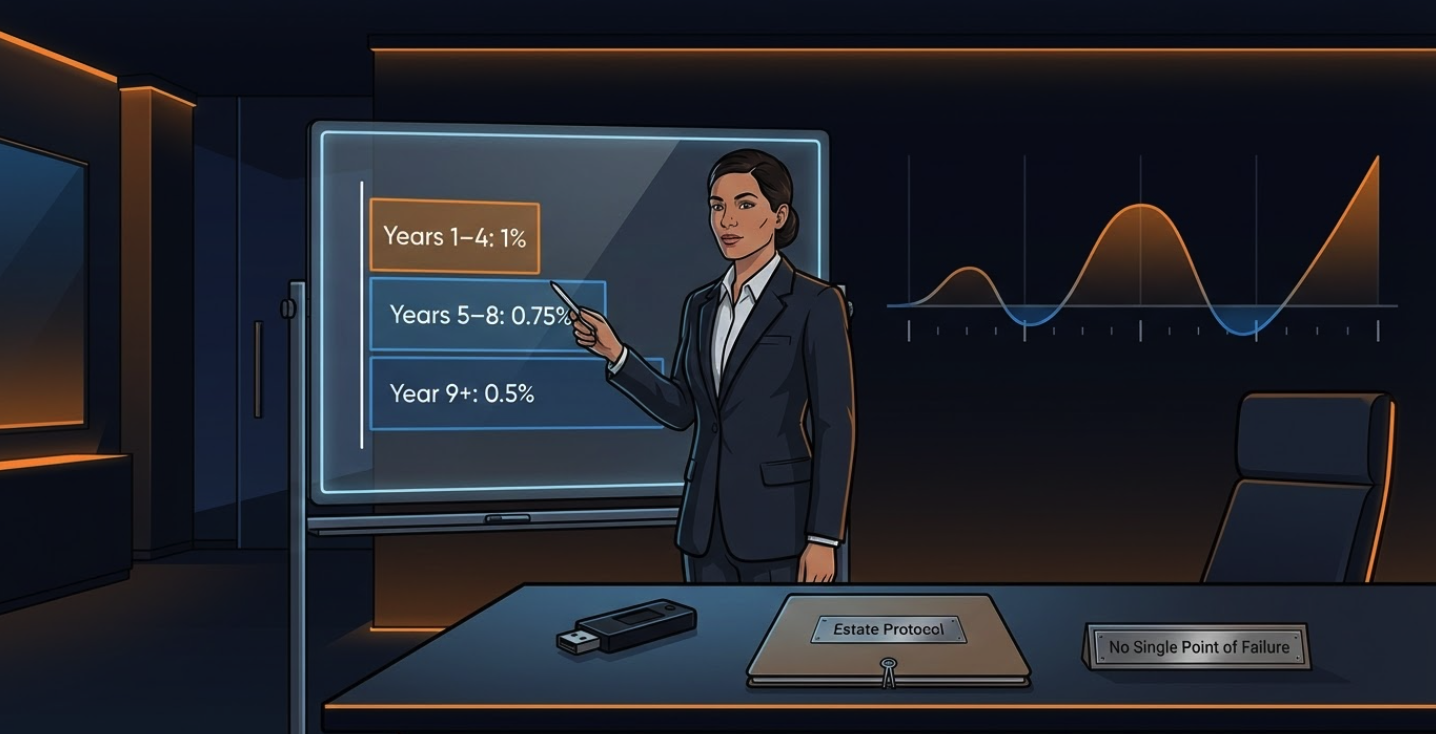

As your relationship with us matures, the fee decreases in stages, aligned with Bitcoin's four-year halving cycle—reflecting lower ongoing setup work and rewarding long-term stewardship.

Years 1–4

Years 5–8

Year 9+

Quick Read

- Fees calculated on average balance over 90 days, invoiced in arrears for each vault

- Invoices issued every 90 days, payable in Bitcoin (sats) within seven days

- Fees only charged once they reach 100,000 sats—smaller holdings often invest time rather than fees

- No hidden charges, no surprises—straightforward and transparent

- Degrading fee structure rewards long-term clients aligned with Bitcoin halving cycles

For full legal terms, including early termination fees, see our Terms of Service.

How It Works

Fee Calculation

Fees are calculated on the average Bitcoin balance over 90 days for each vault. You're issued an invoice in arrears for each vault, with additional invoices issued every 90 days thereafter.

Payment Method

All fees are payable in Bitcoin (sats), the smallest unit of Bitcoin. This ensures seamless transactions within the Bitcoin ecosystem—no fiat conversion required.

Billing Cycle

Invoices are issued every 90 days in arrears for each vault, based on the average balance over that period. You'll receive clear invoices showing exactly what you're paying and why, payable within seven days.

Minimum Threshold

Fees accrue monthly but are only charged once they reach 100,000 sats. Clients with smaller holdings gain the same security oversight while investing time rather than fees.

Degrading Fee Structure

Our fee structure decreases over time—aligned with Bitcoin's four-year halving cycle. This rewards long-term partnership and reflects that established systems require less intensive support. It's a unique approach in the Bitcoin advisory space.

Everything Included in Your Fee

Collaborative Security

- 2-of-3 multisig design tailored to your family

- Hardware wallet setup and rotation planning

- Regular security audits and verification

- Emergency recovery workflows

Estate Planning

- Comprehensive estate documentation

- Beneficiary onboarding and training

- Inheritance path documentation

- Optional orientation sessions

Advisory Services

- Direct access to senior advisers (no call center)

- Market analysis and curated insights

- Accountant liaison and audit support

- Ongoing guidance and support

Portfolio Growth

- Help identifying additional sources of funds

- Education for partners and family

- Strategic planning for Bitcoin allocation

- Resources to grow holdings over time

Our structure is designed to remain resilient even if advisers, firms, or vendors change. Learn more about continuity →

Calculate Your Fees Over Time

See how our degrading fee structure works with your Bitcoin holdings. Adjust your inputs to model different scenarios and understand the true cost of securing your Bitcoin.

Your Scenario

Summary Results

Total Fees (BTC)

Total Fees (USD)

Final Holdings

Catastrophic Loss Risk

Fee as % of Final Holdings

Year-by-Year Breakdown

| Year | Holdings Start (BTC) | Fee Rate | Annual Fee (BTC) | Holdings Value (USD) | Holdings End (BTC) |

|---|

The True Cost of Not Securing Your Bitcoin

A 1% annual fee equals 0.01 BTC on a 1 BTC balance. Set that against the 100% loss families face after fire, theft, misplaced credentials, or exchange failures. The math is stark: our fee protects against total loss while maintaining your control.

Exchange Custody Risk

Mt. Gox, FTX, Celsius, BlockFi—the list of exchange failures is long. When exchanges collapse, you lose everything. Our 1% fee protects against this 100% loss risk while keeping you in control.

Cost of inaction: 100% of holdings at risk

Solo Self-Custody Risks

Fire, theft, forgotten passphrases, hardware failure, or simple mistakes can wipe out a lifetime of savings. Single points of failure mean one error equals total loss.

Cost of inaction: 100% loss from any single failure point

Inheritance Without Planning

Without proper estate documentation, your Bitcoin may be lost forever when you're gone. Beneficiaries can't access what they don't know exists or how to recover.

Cost of inaction: Generational wealth lost to time

Our 1% Fee

Protects against all these risks while maintaining your control. You keep 99% upside, eliminate single points of failure, and ensure your Bitcoin survives you.

Cost of action: 1% annually, decreasing over time

Why 1% Represents Great Value

Our 1% fee enables you to realize 99% upside retention. Compared to other custody and financial products that often charge more than twice this for substantially less service, you'll find it represents great value for money. It's not just a fee; it's an investment in a secure future for your Bitcoin.

When you look back on experiences in life, you rarely remember what they cost. What stays with you is the value they brought, the safety they provided, and the satisfaction they delivered. The same is true for securing your Bitcoin—value is remembered long after price is forgotten.

Read more about our pricing philosophy →

"I was always apprehensive about the safety of my Bitcoin holdings. Since partnering with The Bitcoin Adviser, I've found incredible peace of mind, thanks to their robust custody solutions and thorough inheritance planning."

— Client Testimonial

Proof Points

Common Questions About Our Fees

Is 1% Too Much?

Let's do the math: On 1 BTC at $85,000, your first-year fee is $850 (0.01 BTC). That's 1% of your holdings. Compare that to:

- Exchange failure: 100% loss (you lose everything)

- Solo custody mistake: 100% loss (one error, total loss)

- Other custody solutions: Often 2%+ annually for less service

- Our 1% fee: Protects against 100% loss, keeps 99% upside, decreases over time

The question isn't whether 1% is too much—it's whether you can afford the risk of losing everything. Our fee is insurance against catastrophic loss while maintaining your control.

Why Not DIY?

DIY self-custody can work if you have the technical expertise, time, and confidence to manage multisig setups, estate documentation, and beneficiary training yourself. Many Bitcoiners successfully self-custody.

DIY makes sense if:

- You're technically proficient and comfortable with multisig

- You have time to research, implement, and maintain security

- You can document estate plans and train beneficiaries yourself

- You're confident handling emergencies and recovery scenarios

Professional help makes sense if:

- You want to eliminate single points of failure without complexity

- You value documented processes and professional oversight

- You want beneficiaries trained by experts, not left to figure it out

- You prefer peace of mind over saving 1% annually

We publish free resources—including the Bitcoin Risk Assessment—so every Bitcoiner can review their posture even if we never partner together.

Why 1% When Starting?

The first four years represent the highest-value period where we establish your collaborative security structure, document your estate plan, and train all stakeholders. This intensive setup phase requires the most support and guidance.

How Do Fees Decrease Over Time?

Our degrading fee structure is aligned with Bitcoin's four-year halving cycle. Years 1-4: 1%, Years 5-8: 0.75%, Year 9+: 0.5%. This rewards long-term clients and reflects that established systems require less intensive support.

Why Pay in Bitcoin?

We're Bitcoin-native. Paying fees in sats (the smallest unit of Bitcoin) keeps everything within the Bitcoin ecosystem—no fiat conversion required. It's straightforward, fair, and resonates with the unique dynamics of Bitcoin investment.

What About Early Termination?

Early termination fees apply if you leave within the first four years. These are calculated on your Bitcoin balance at termination: Year 1 (4%), Year 2 (3%), Year 3 (2%), Year 4 (1%), Year 5+ (0%). See our Terms of Service for full details.

What If My Holdings Are Small?

Fees accrue monthly but are only charged once they reach 100,000 sats. Clients with smaller holdings often invest time rather than fees, while gaining the same security oversight and support.

How Does This Compare to Exchange Custody?

Exchange custody may seem "free" but carries 100% loss risk (see Mt. Gox, FTX, Celsius). Our 1% fee protects against catastrophic loss while maintaining your control. The cost of losing everything far exceeds our transparent fee structure.

When We're NOT Right For You

We work with households that treat Bitcoin as a generational asset and value education, transparency, and documented processes. If your priorities differ, another path may serve you better.

You Prefer Exchange Custody

If you believe exchanges are "insured" and prefer the convenience of leaving Bitcoin on platforms, we take different approaches to risk. That's okay—we publish free resources so you can review your posture regardless.

You Want Completely Hands-Off

If you want zero involvement in security, documentation, or beneficiary training, we may not align. Collaborative security requires some participation—you remain in control, which means some engagement is necessary.

You're Searching for Shortcuts

If you're looking for speculative shortcuts rather than long-term resilience, we focus on different outcomes. We're built for generational wealth preservation, not quick gains.

You're Unwilling to Learn Basics

If you're unwilling to learn the fundamentals of collaborative security, we may not be the right partner. Education is core to our approach—we help you understand, not just trust a black box.

That is alright. We publish free resources—including the Bitcoin Risk Assessment—so every Bitcoiner can review their posture even if we never partner together. If collaborative security fits your goals, we're here. If not, we're still here to help you understand your options.

Ready to Secure Your Bitcoin?

If this pricing structure aligns with your goals, set up a discovery call or run the risk assessment to benchmark your current setup. There's no obligation—just clarity on whether collaborative security fits your needs.

Before you decide, see what working with us actually looks like. What to Expect →

Want to understand if you're a good fit? See if The Bitcoin Adviser is right for you →

Need full legal terms? Review our Terms of Service →